By Combining Multiple Less-Advanced Chips, Chinese Firms Hope To Skirt US Sanctions

In recent years, US sanctions have tightly constrained the Chinese semiconductor industry, creating significant challenges for its advancement. While Chinese companies can still produce chips for current applications, restrictions on importing certain chipmaking technologies have severely hindered their ability to develop more sophisticated products.

However, amidst this restrictive landscape, a promising solution has emerged in the form of chiplets. These innovative modular components offer China a strategic opportunity to bypass export bans, foster self-sufficiency, and remain competitive on the global stage, particularly against the backdrop of US dominance.

Over the past year, both the Chinese government and private investors have shown keen interest in bolstering the domestic chiplet sector. Academic researchers are being incentivized to tackle cutting-edge challenges in chiplet manufacturing, while emerging startups like Polar Bear Tech have already introduced their inaugural products.

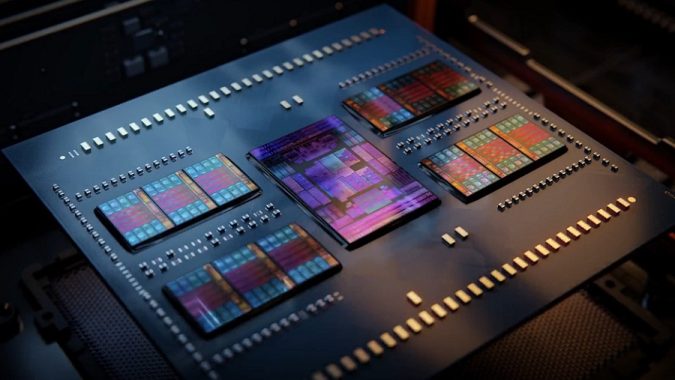

Unlike traditional chips that integrate all functionalities onto a single silicon substrate, chiplets adopt a modular approach. Each chiplet serves a specific function, such as data processing or storage, and is interconnected to form a cohesive system. This modular design not only streamlines manufacturing processes and reduces costs but also enhances reliability, as individual chiplets can be easily replaced with upgraded versions to enhance performance while maintaining overall system integrity.

Chiplets have garnered significant attention for their potential to sustain technological advancements in the semiconductor industry beyond the confines of Moore’s Law. Recognizing their transformative impact, influential players in the chip sector, including AMD, Intel, and Apple, have already incorporated chiplet technology into their products.

While chiplets offer a pathway for continued innovation in chip design, their adoption presents a particular opportunity for Chinese chip companies. By leveraging chiplet technology, these companies can expedite the development of more powerful chips domestically and cater to burgeoning sectors such as artificial intelligence (AI). However, realizing this potential hinges on substantial investments in chip-packaging technologies that facilitate seamless integration of chiplets into cohesive devices.

“The development of advanced packaging technologies necessary for chiplet deployment is undoubtedly on China’s agenda,” notes Cameron McKnight-MacNeil, a process analyst at TechInsights. “China possesses fundamental underlying technologies for chiplet deployment.”

Nevertheless, challenges persist. US export restrictions have prompted China to seek alternative pathways for semiconductor development, with chiplet technology emerging as a promising workaround. By modularizing chip functions, China can potentially achieve comparable computing power to restricted US chips. However, this approach poses significant challenges in chip packaging, requiring sophisticated techniques and investments. Nonetheless, China’s existing prowess in chip packaging offers a foundation for advancement in this critical area, potentially positioning it as a formidable player in the global semiconductor landscape.

Chiplet Sector Sees Venture Capital Interest Skyrocket

In the semiconductor industry, the development of chiplets requires significant financial investment. However, driven by a pressing need to rapidly advance the domestic chip sector, the Chinese government and various investors have already begun pouring funds into chiplet research and startup ventures.

In July 2023, the National Nature Science Foundation of China, the leading state fund for fundamental research, unveiled its ambitious plan to support 17 to 30 chiplet research projects encompassing design, manufacturing, packaging, and more. Over the next four years, the foundation aims to allocate between $4 million and $6.5 million in research funding, with the overarching goal of enhancing chip performance by “one to two magnitudes.”

While this funding primarily targets academic research, several local governments are also poised to invest in industrial opportunities related to chiplets. Wuxi, a mid-sized city in eastern China, is positioning itself as a pivotal hub for chiplet production, envisioning a “Chiplet Valley.” In a proactive move, Wuxi’s government officials proposed establishing a $14 million fund to attract chiplet companies to the city, successfully luring a handful of domestic enterprises.

Simultaneously, a wave of Chinese startups specializing in the chiplet domain has garnered substantial venture backing. Notably, Polar Bear Tech, a Chinese startup dedicated to developing universal and specialized chiplets, secured over $14 million in investment in 2023. The company unveiled its inaugural chiplet-based AI chip, the “Qiming 930,” in February 2023. Other startups like Chiplego, Calculet, and Kiwimoore have also received significant financial backing to produce specialized chiplets catering to various applications such as automotive technology and multimodal artificial intelligence models.

Obstacles Persist

While adopting a chiplet approach offers numerous benefits such as cost reduction and enhanced customizability, it also presents trade-offs that must be carefully navigated. One of the primary challenges is the increased complexity of chip design, as more components require additional connections. This heightened interdependency means that a single fault in any component can lead to the failure of the entire chip, underscoring the critical importance of compatibility between modules.

Moreover, the process of connecting or stacking multiple chiplets can result in elevated power consumption and accelerated heat generation, potentially compromising performance and even causing damage to the chip itself. To mitigate these risks, companies designing chiplets must adhere to standardized protocols and technical specifications.

Globally, efforts have been made to establish universal standards for chiplet interconnectivity, such as the Universal Chiplet Interconnect Express (UCIe), proposed by major industry players in 2022. However, divergent interests have led some Chinese entities to develop their own chiplet standards, leading to fragmentation within the industry.

The absence of a universally recognized standard impedes the full realization of chiplet technology’s potential for customizability. Without such standardization, companies may revert to traditional single-piece chips, undermining the progress made in chiplet development.

For China, adopting chiplet technology presents opportunities to enhance chip performance and circumvent restrictions on accessing advanced chip technologies. However, it does not address other significant challenges, such as the difficulty of obtaining or manufacturing lithography machines essential for chip fabrication.

While combining multiple less-advanced chips may offer a performance boost, it is unlikely to yield chips that surpass existing top-tier products. Additionally, ongoing updates and expansions of semiconductor sanctions by the US government could subject chiplet technologies to further restrictions.

The practical and political obstacles surrounding chiplet development suggest that its realization will require considerable time and effort, despite substantial political will and investment. While chiplets may offer a shortcut for the Chinese semiconductor industry to bolster its chip capabilities, they are unlikely to serve as a panacea for the broader US-China technology rivalry.

Comments are closed