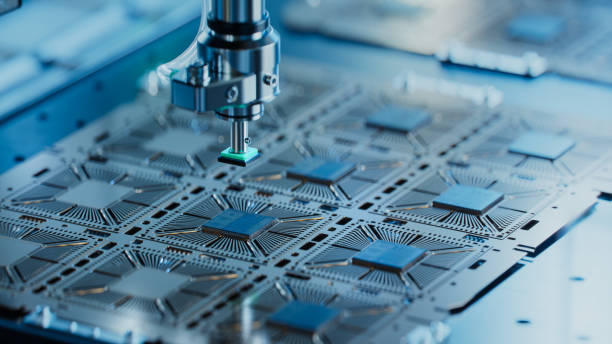

The global chipmaking industry, a crucial engine powering everything from smartphones to artificial intelligence, is experiencing a tremor of uncertainty. ASML, the world’s leading supplier of the complex machines that manufacture these tiny marvels, missed sales forecasts in the first quarter, sending shockwaves through the tech sector. This unexpected stumble has investors worried about potential domino effects for chipmakers like Apple supplier TSMC and Intel, who rely on ASML’s bleeding-edge equipment to etch the intricate circuits on microchips.

A Missed Target and a Shifting Outlook

ASML’s sales shortfall wasn’t a minor blip. The company’s revenue dropped over 20% compared to the same period last year. This significant decline stems from a slowdown in demand for their most advanced machines, the workhorses that churn out the most powerful chips. This could be the first sign of a cooling-off period in the previously white-hot AI market, which earlier in the year fueled a surge in chip demand.

While ASML didn’t completely abandon its 2024 forecast, they did make a significant adjustment. The company is now pushing most of its expected sales growth to the latter half of the year. This suggests a potentially volatile first half, with weaker-than-anticipated performance. Analysts interpret this shift as a sign of potential turbulence ahead for the chipmaking industry as a whole.

Uneven Demand and a Glimmer of Hope

The slowdown appears to be geographically uneven. While sales in key markets like Taiwan and the US dipped, China – interestingly – remained a bright spot. Despite restrictions on selling them the most cutting-edge machines, ASML reported robust growth in the Chinese market. This geographic disparity adds another layer of complexity to understanding the current market dynamics.

Long-Term Optimism Amidst Short-Term Hiccups

Despite the short-term sales slump, ASML maintains a positive outlook for the long haul. They view 2024 as a year of strategic investment and preparation for a future upswing in the chip market. The company also emphasized that they turned a healthy profit even with the sales decline, demonstrating continued financial stability.

Market Jitters and Investor Caution

The stock market, however, wasn’t swayed by ASML’s assurances. Investors reacted swiftly, sending the company’s share price tumbling. This highlights the sensitivity of the chipmaking industry to even minor fluctuations. The market will likely remain cautious until ASML’s next earnings report, hoping to avoid a repeat performance.

A Ripple Effect Throughout the Tech Ecosystem

The episode underscores the interconnectedness of the global chipmaking industry. A slowdown at ASML can have cascading effects, impacting major players like TSMC and Intel who rely on their equipment. While ASML’s long-term confidence suggests this might be a temporary pause, it serves as a stark reminder of the delicate balance and potential vulnerabilities within the chipmaking ecosystem. The coming months will be crucial in determining whether this is a short-lived tremor or a sign of a more prolonged industry shift.